How Ghana’s Debt Affects Everyone

As food prices rise, transport fares jump, and the cedi struggles to hold its value, most Ghanaians are focused on surviving the day. But behind these everyday challenges lies a much bigger story — one that shapes how much we pay for food, rent, and school fees. Ghana’s debt problem might sound like an issue for policymakers and economists, but it affects every single Ghanaian, from traders at Kaneshie to teachers in Bolgatanga.

A Turning Point in Ghana’s Debt Story

In June 2025, Ghana reached a $2.8 billion debt relief deal with creditor nations including China, France, and the United Kingdom. The government described it as a historic turning point — a lifeline after years of financial strain and inflation. Yet for ordinary citizens, the key question remains: what does this deal actually mean for their daily lives?

Despite Ghana’s abundant natural resources, the nation owes more than $50 billion to foreign lenders. Paying interest on this debt takes up a massive share of government revenue, leaving little for schools, hospitals, and infrastructure. The new debt relief agreement allows creditors to delay, reduce, or restructure payments — giving Ghana breathing room to stabilize its finances, much like getting an extension to pay off a personal loan.

How Debt Relief Could Help Everyday Ghanaians

When the government spends less on debt payments, it can channel funds into stabilizing the economy and strengthening the cedi. A stronger cedi means imported goods like fuel, rice, and cooking oil may not rise in price as quickly. As Abena, a trader at Kaneshie Market, said, “If I can buy cooking oil at the same price next month, that alone is relief.” Prices might not drop immediately, but slowing inflation gives families a chance to catch their breath.

Debt relief could also allow the government to focus on essential public services and job creation. Billions of cedis currently used to pay creditors could instead support teacher salaries, improve healthcare, and boost farming programs. With this financial breathing space, the government can strengthen local industries, invest in infrastructure, and pay public workers on time — actions that make money circulate again in communities.

Building Confidence and Attracting Investment

A country’s debt management signals its economic credibility. When Ghana demonstrates seriousness in managing its finances, investor confidence grows. Foreign companies are more likely to invest, local businesses can expand, and banks become more willing to lend. This creates jobs and helps stabilize the economy further.

However, debt relief is not a quick fix. It does not put cash directly in people’s pockets, and its impact will take time to show. Ghana has been here before — after debt relief in 2005, the country eventually slipped back into heavy borrowing. Without discipline, transparency, and smart investment in local production, history could repeat itself. As Bright Simons of IMANI Africa warned, “We can’t keep borrowing to fix what borrowing caused.”

The Stakes Are High — For Ghana and Beyond

Ghana’s performance under this new debt deal will send a strong signal to the rest of the world. Other African nations, such as Zambia and Ethiopia, are also renegotiating their debts. If Ghana succeeds, it could attract more investment, strengthen the cedi, and build a reputation as a stable and trustworthy economy. Failure, on the other hand, could make future borrowing harder and slow national growth.

For ordinary citizens, the results will unfold gradually. Prices may stabilize, jobs may become more available, and public services could improve if funds are managed responsibly. Inflation might ease, but global prices — especially for fuel and imports — will still play a role.

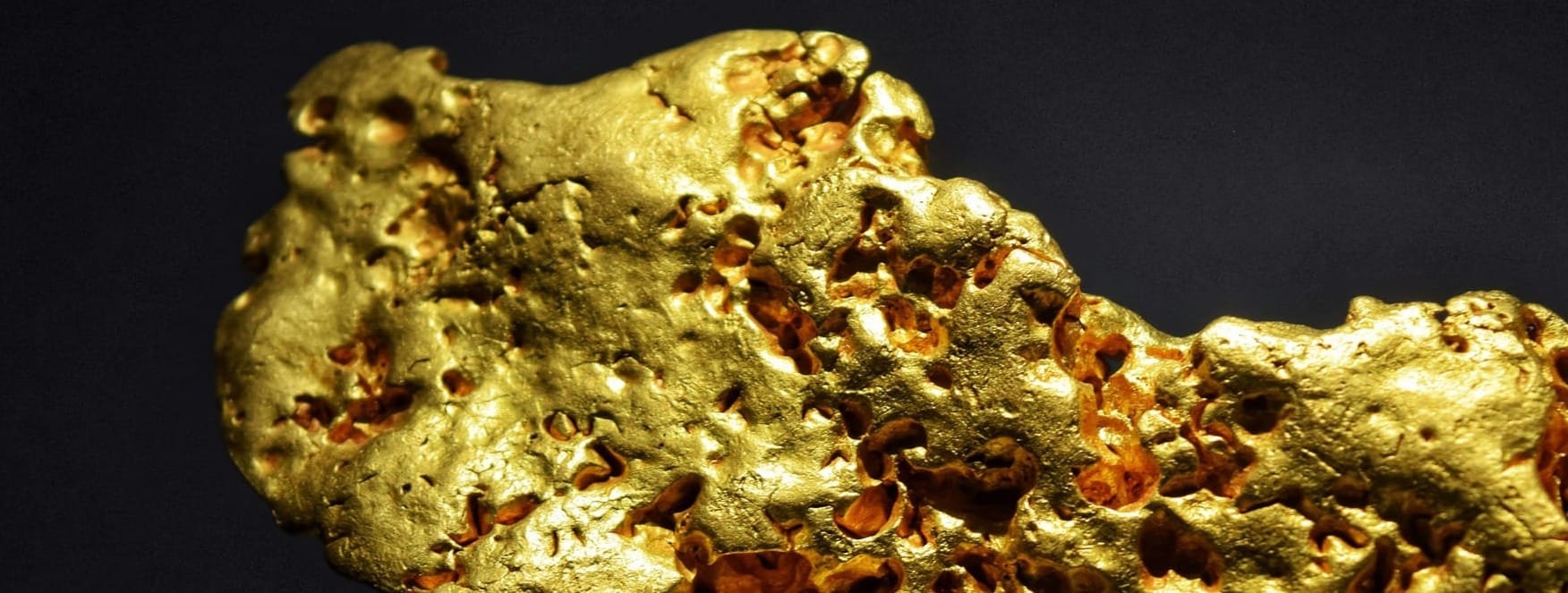

Leveraging Ghana’s Resources for Long-Term Growth

Debt relief gives Ghana a chance to breathe, but lasting change requires more than temporary relief. The country must leverage its abundant natural and mineral resources — gold, oil, bauxite, and lithium — to strengthen the economy and pay down its debts. Ghana, like many African countries, sits on wealth worth far more than its debt. The real challenge is ensuring that this wealth benefits Ghanaians first.

National policies must shift toward genuine self-reliance. That means prioritizing local industries, reducing wasteful spending, and ensuring that the nation’s resources are used for the public good. True debt relief isn’t just about pausing payments; it’s about restructuring the economy so that the average citizen sees real improvements in living standards.

Putting Ghanaians First

For nearly seven decades, Ghanaians have worked hard, sacrificed, and hoped for a fairer future. This new debt relief deal offers another opportunity to reset and refocus. If the government uses this moment wisely — investing in productive sectors, cutting corruption, and building public trust — ordinary citizens could finally feel real change.

In the end, debt relief isn’t just about billion-dollar agreements signed in Accra or Paris. It’s about how much you spend at the market, how secure your job is, and how stable the cedi remains. The choices Ghana makes today will determine whether this moment becomes just another cycle of borrowing — or the beginning of a stronger, fairer economy for everyone.

Share your thoughts.

Comments ()